With the dramatic rise in the value of cryptocurrencies in recent years, theft in this space has surged accordingly. It seems that cybercriminals have concluded that stealing digital currencies is not only easier than targeting traditional fiat currencies like dollars, pounds, or euros, but also comes with far fewer legal consequences.

At Ouroboros Security, we’ve noticed a sharp increase in Digital Forensics Investigation requests specifically related to cryptocurrency thefts. As crypto prices have soared, our backlog of cases involving stolen digital assets has grown significantly. Here, we share some of the insights we’ve gathered through our investigations.

Major Cryptocurrency Thefts That Shook the Industry

As crypto valuations have climbed and law enforcement remains largely unequipped or indifferent, digital currencies have become a prime target for hackers. Some of these thefts are staggering in scale—had they involved fiat money, they’d dominate global headlines. Yet, most go unnoticed beyond niche blogs and forums. Even the most serious cases are rarely resolved.

Below are a few notable examples of large-scale cryptocurrency heists. While these represent the tip of the iceberg, millions of users have quietly lost their digital wealth without any public attention.

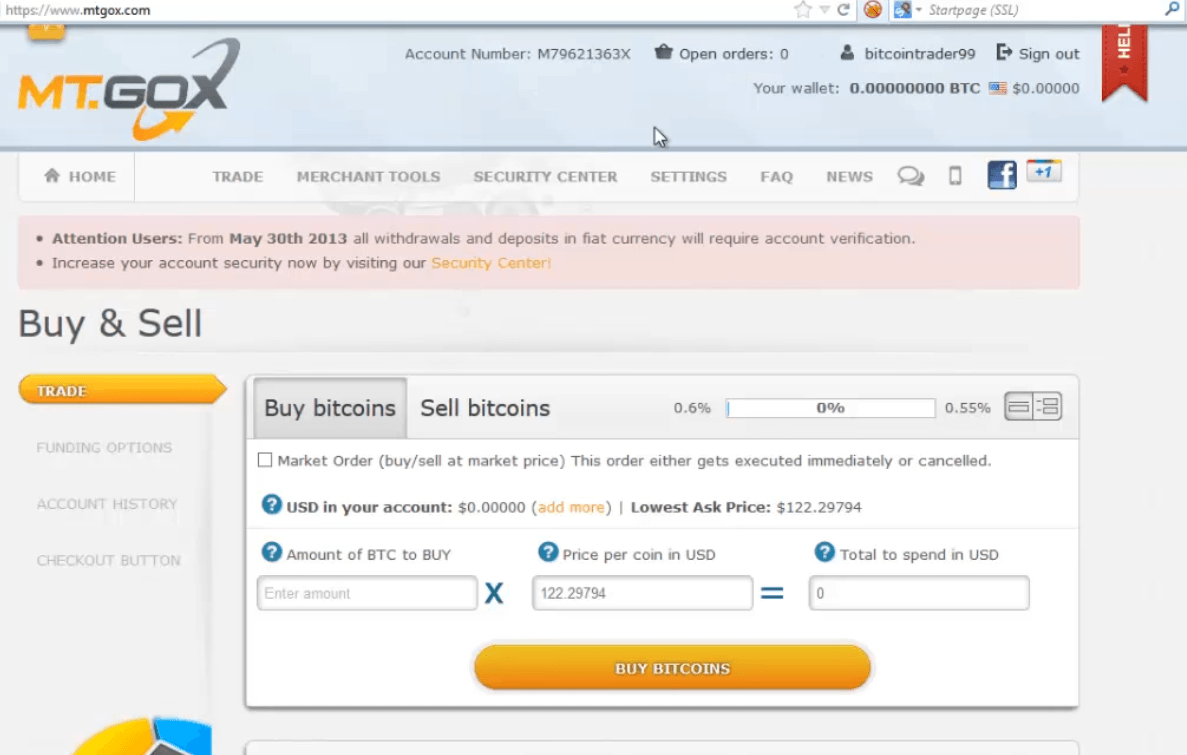

Mt. Gox

One of the most infamous incidents, Mt. Gox, a Japan-based crypto exchange, was handling nearly 70% of global Bitcoin transactions when it collapsed in 2014. Hackers reportedly exploited a compromised user account to siphon off over 850,000 BTC, which would be worth around $89.2 billion today. The perpetrator remains unidentified, though an IP address linked to the theft traced back to Hong Kong.

Silk Road

Known as the most well-known darknet marketplace, Silk Road offered everything from drugs to weapons. When the FBI shut it down in 2014, they seized around 30,000 BTC from the platform and an additional 144,000 BTC from its founder, Ross Ulbricht (aka “Dread Pirate Roberts”). At today’s value, that stash would total over $18.3 billion. Interestingly, two Secret Service agents involved in the case, Shaun Bridges and Carl Force—were later convicted for stealing $16 million in bitcoin and are currently serving prison sentences.

Coincheck

In early 2018, Tokyo-based exchange Coincheck lost 500 million NEM tokens in a breach, overtaking Mt. Gox in terms of scale. The hackers infiltrated Coincheck’s systems and extracted funds from their vulnerable “hot wallets”—those connected to the internet.

Common Methods Hackers Use to Steal Crypto

Based on our investigations and industry reports, we’ve identified several recurring tactics that criminals use to steal cryptocurrencies.

Private Key Theft

Cryptocurrencies are secured via private cryptographic keys—essentially long alphanumeric codes. These keys often reside on users’ devices or cloud services. If a hacker gains access to this key, they can instantly move the funds to their wallets.

Often, attackers target platforms like Coinbase by stealing login credentials through phishing or malware. Even with Two-Factor Authentication (2FA), hackers can intercept SMS-based codes via SS7 attacks or gain access to email accounts to bypass verification processes. With some early crypto users holding wallets worth millions today, compromising just a few accounts can yield massive payouts.

Transfer Trojans

Disguised as benign programs, these malware variants monitor users’ transactions. When someone initiates a crypto transfer, the Trojan swaps the intended wallet address with the hacker’s, diverting the funds without raising suspicion.

Mining Hijacks

With thousands of mining rigs running nonstop, hackers often target poorly secured setups. By breaching these systems, they can reroute the mined coins to their wallets, effectively stealing the fruits of someone else’s mining labor.

SS7 Exploits

Many trading platforms rely on 2FA via SMS. But the Signaling System No. 7 (SS7) protocol, which underpins telecom messaging, can be exploited. Attackers use this vulnerability to intercept OTPs (One-Time Passwords), allowing them to bypass 2FA entirely and gain full account access.

Botnets for Mining

Hackers frequently assemble botnets—networks of infected machines—to mine crypto without the device owners’ knowledge. These botnets can generate millions in crypto. Sometimes, rival hackers hijack these botnets by attacking their command centers (often on IRC) and rerouting the mining profits to themselves.

Fake Tech Support

We’ve investigated cases where scammers impersonated customer support staff from crypto exchanges. By mimicking official websites and reaching out via social media, they trick users into handing over login credentials, then drain their wallets almost instantly.

Flaws in Internal Systems

Unlike enterprise software, much of the code powering crypto exchanges and platforms is custom-built and hasn’t undergone rigorous security testing. These internal vulnerabilities—such as those seen in Mt. Gox and Coincheck—leave systems open to exploitation.

Phishing Attacks

Phishing remains a cornerstone of cybercrime. Many thefts we’ve seen started with an unsuspecting user clicking on a malicious link or attachment. The attacker then installs malware or rootkits that grant access to wallets or exchange accounts, leading to direct asset theft.

Final Thoughts

The cryptocurrency ecosystem, while revolutionary, is still maturing—and so are the methods used to attack it. As crypto adoption increases, so too will the sophistication of these heists.

At Ouroboros Security, we continue to monitor, investigate, and learn from each case we handle. If you’re a crypto holder, trader, or business, now is the time to take proactive steps to secure your assets. Use hardware wallets, enable multi-factor authentication, stay alert for phishing attempts, and monitor your accounts regularly.

We’ll continue sharing updates and new attack vectors as they emerge. Need help investigating a potential crypto theft or securing your digital assets? Contact us today.

0 Comments